Inflation: What, Why and Should I Panic?

Demystifying all the recent inflation news

It feels like I should be worrying about inflation?

When $1 pizza isn’t a dollar anymore, I understand why it feels like it’s time to panic about prices. Or you may have seen Jerome Powell, the Chairmen of the Federal Reserve, announce last week that the Fed would taper its Bond buying (an economic stimulus) partially in response to rising inflation. Yes, inflation has increased and is at its highest rate in a decade, but it’s important to look at the reasons why and the long run situation.

Ok, but what is inflation?

Simply put: inflation is how much prices are rising, usually measured over a year. The number you’ve probably seen the most recently is that prices are up 5.4% in 2021. That is the Consumer Price Index (CPI) which is put together by the Bureau of Labor Statistics (BLS) based on a typical basket of goods and services Americans spend money on.

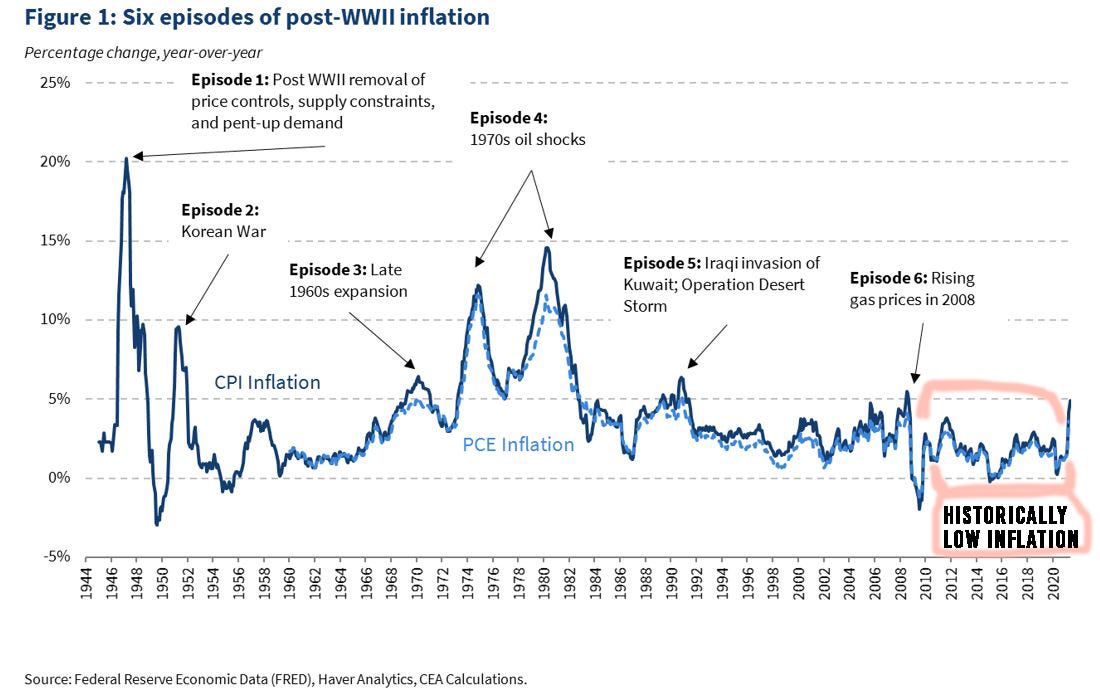

In the U.S., 2% was generally seen as the target inflation rate. However, since the Great Recession inflation has been historically low , and since 2010 the Fed has actually worried about too little inflation not too much.

Wait, prices haven’t been going up since 2008?

If you’ve paid rent, medical bills, tuition or a myriad of other things in the last decade the idea that prices were relatively stable probably sounds bananas. While the CPI tries to measure what an average American is spending each month, it is often cited as incomplete. It also has political implications because CPI is what is used when deciding on increases in programs like Social Security. The history and controversies of the CPI could be an entire newsletter, but just know it’s not necessarily a perfect measure.

But if inflation was too low, why is everyone freaking out now that it’s increasing?

At the end of 2020 and the beginning of 2021, higher inflation was expected due to strong consumer demand, labor constraints and supply chain bottlenecks from the Pandemic. The main reason so much has been written lately about inflation is that it has stayed high much longer than anyone, including the Fed and the White House, expected.

“Inflation has come in higher than expected and bottlenecks have been more persistent and more prevalent,” [Powell] added. “We see that they’re now on track to persist well into next year. That was not expected by us, not by other macro forecasters.”If inflation is still high, why does Powell keep using the word transitory?

Other than “inflation,” the word you may have heard the most in the news is “transitory.” Transitory inflation means that inflation is temporary and prices will naturally level off as external factors (like supply bottlenecks) ease. Powell has continued to say that inflation is transitory, but others like Atlanta Fed President Raphael Bostic disagree with the continued use of the term.

No matter what you call this period of inflation, prices will not generally be going back down even as the rate they’re increasing (inflation) slows.

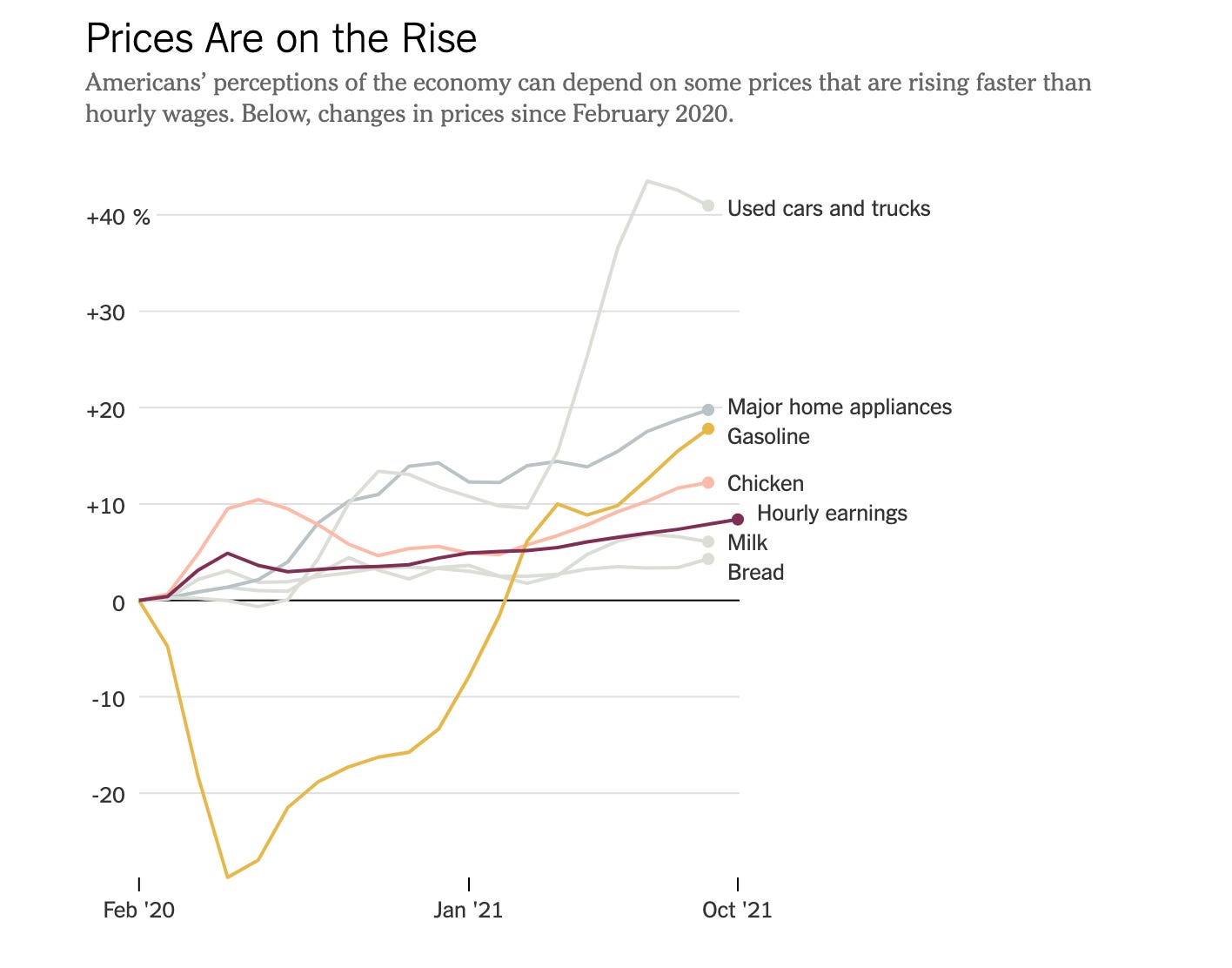

Source NYTimes

Brushing off inflation as “Transitory” glosses over the economic reality of low income Americans

“Any time someone is low income, that means they’re spending a higher percentage on needs like food and housing,” said Diane Whitmore Schanzenbach, director of the Institute for Policy Research at Northwestern University. “When prices go up, they have less slack in their budgets to offset and they are quick to fall into hardship.”Despite higher prices, generally consumer demand has remained high due in part due to many American’s record high savings and government stimulus. But inflation is a real problem for lower income Americans, many of whom are still out of work, receiving low wages and/or getting less help from the government. Even food banks are struggling with higher food costs.

Yes, the unemployment rate went down overall to 4.6% in October, but other measures of the labor market were less encouraging. The Black unemployment rate was flat at 7.9%, twice the white unemployment rate, and the Labor Force Participation Rate (percent of adults working or actively looking for work) is the lowest it has been since the 1970s.

Despite headlines about wages rising, real wages (i.e. adjusted for cost of living) have actually fallen .5%. Wages for low wage workers were already stagnant since 2008 and had only starting to show signs of increasing right before the COVID recession.

Some good news is that while inflation is expected to level off eventually, there are signs that wages will continue to increase as competition for workers remains tight and that could mean real wages finally increasing.

Ok, this is a problem, but probably one that is starting to ease, so why do old dudes keep bringing up the 70s?

From 1973-1982 the US experienced an era of “stagflation” meaning high inflation and slow economic growth. A lot of policy makers are of, um, advanced ages and vividly remember the 70s and the drastic actions the Fed took in response like raising interest rates to 20%. But, in the 70s inflation was in double digits and the the overall unemployment rate was almost 9% .

Today, economic growth is still expected to be strong, even if it is slightly lower than forecasts from the first half of 2021. And inflation is expected to level off naturally without too much intervention from the Fed. Even if the Fed did eventually raise rates to fight inflation, the current rate is close to 0%. Another important change from the 70s is how Powell views the role of the Fed. The Fed has historically had a dual mandate: keep inflation low and reach full employment, but Powell has said he is more focussed on full employment even if that means keeping ultra low interest rates and accepting some inflation.

Basically, it’s a different situation and a different Fed, so feel free to ignore all the comparisons.

So…how worried should I be?

Janet Yellen said things will probably not normalize until mid-2022. Even then prices will likely not go back down (except gas which is honestly a totally separate and crazy market) they just won’t be rising as quickly.

It’s important to remember how you see a problem impacts what actually happens. Inflation is in someways a self fulfilling prophecy. If consumers or businesses expect the cost of goods and services to keep rising, they change their behavior which could cause more inflation. Inflation is also fueling perception that the economy is doing worse than it actually is, and that could stop important government spending needed to grow the economy.

“Republicans have begun wielding every new inflation data point as an argument against more federal spending.”Like pretty much everything in the economy, you can only predict so much and yes there always is the possibility things change. But for now inflation is something to keep an eye on, but not panic about and not let mask the other strong economic indicators.

Read more:

The impact of inflation on lower income Americans:

https://www.nytimes.com/2021/10/27/business/economy/food-prices-us.html

How a good economy can feel crappy:

https://www.nytimes.com/2021/11/06/upshot/inflation-psychology-economy.html

Shadow inflation (or skimpflation):

https://www.nytimes.com/2021/10/10/upshot/shadow-inflation-analysis.html